Blog

When it’s time to rebuild: Using your mortgage to recover financially

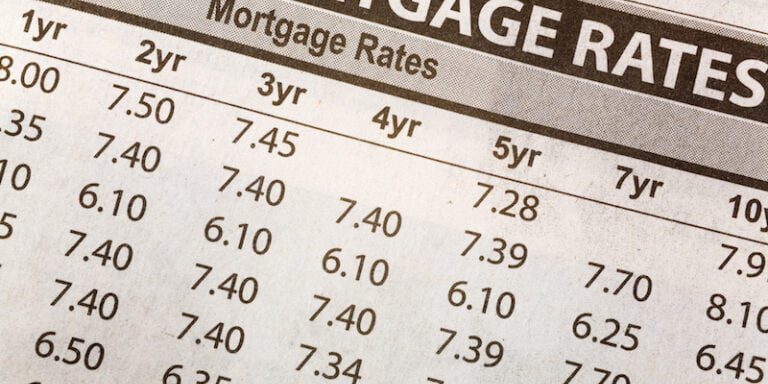

Your mortgage is probably the largest debt you’ll ever take on. Signing a binding contract that instantly puts you hundreds of thousands of dollars into debt can be a daunting notion, even for those who aren’t first-time homebuyers. But taking...