Blog

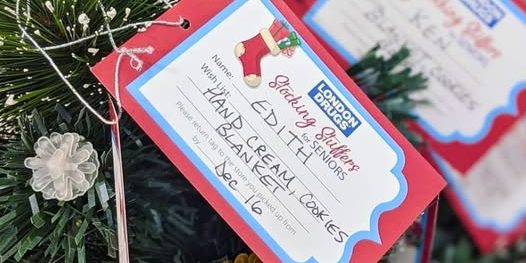

The Magic of Kindness: A Christmas Story from London Drugs

As we kick off a new year, I wanted to share a deeply personal story that reminded me how life’s smallest moments can lead to the most profound connections. It’s a story about family, kindness, and listening to the quiet...

Happy Canada Day

I have an overactive sense of fairness, which is one of my core values. Fairness means everything to me – it means everyone has the opportunity to enjoy the same benefits. I’ve struggled with some of the mortgage changes over...