Blog

Purchase Plus Improvement

6 November 2020

You've found the perfect home, but... Oh, that kitchen needs so much work. The carpet needs to be pulled up. The windows are so old. How can we afford a new roof, furnace, or cooling system? It would be perfect...

How to Consolidate Your Debt and Save

6 November 2020

Financial stress is the worst. It's a heavy monkey to carry on your back. Are you looking for a simple way to pay off credit card debt faster? There are solutions. One of the keys to paying off credit card...

Mortgage Repayment Options Explained

6 November 2020

So you've got you're mortgage approval, now the lender gives you the choice of several repayment options. You've heard about the standard monthly payments but what's semi-monthly or accelerated bi-weekly? Which one can save you the most amount in interest...

What does it mean to refinance?

6 November 2020

“My friend rolled their car loan and other debt into their mortgage. Can you do that for us?” When someone says this to me, I know what they really want to do is use the equity they’ve built up in...

The Five “C”s of Credit

6 November 2020

If you're a newcomer to Canada, self-employed, working on commission, or have a poor credit history, you may think your chances of qualifying for a mortgage are slim. Think again! The trick is to see yourself through the eyes of...

Using Equity To Renovate Your Home

6 November 2020

Selling your existing home and buying another home can be very costly and stressful. Suppose you like your current home or your location. In this case, you may want to consider staying where you are and renovating—allowing for you and...

Collateral versus Standard Charge mortgages

7 October 2020

More lenders today are moving towards collateral charge mortgages. Why? Because it glues you to "that" lender. It's not necessarily a bad thing, but you should know what you are signing as it's becoming increasingly important to understand the difference...

Bridge Financing What you need to know

7 October 2020

A bridge loan is a short-term loan that you give yourself. You are borrowing money against your existing home's sale to facilitate the down payment on the home you are purchasing. Bridging is a tool that helps you "bridge" the...

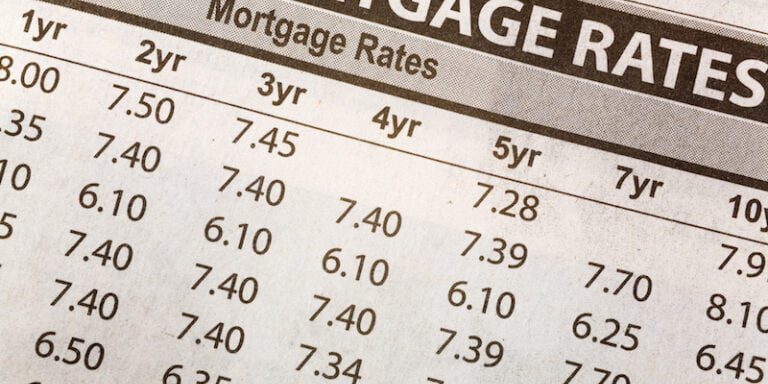

Fixed Vs. Variable Rate

8 September 2020

What's better, a fixed rate or a variable/adjustable rate? Before I answer this question, you must understand the difference between a fixed-rate mortgage, adjustable-rate, and a variable rate mortgage. An educational moment is coming up. Fixed-rate mortgage: - A fixed-rate...