Blog

Fixed Vs. Variable Rate

8 September 2020

What's better, a fixed rate or a variable/adjustable rate? Before I answer this question, you must understand the difference between a fixed-rate mortgage, adjustable-rate, and a variable rate mortgage. An educational moment is coming up. Fixed-rate mortgage: - A fixed-rate...

Thinking About Purchasing, Where To Start

11 June 2020

Are you or someone you know thinking about purchasing but don't know where to start? See below. I am here if you have questions. Call me. Qualifying today has never been more challenging. My initial questions would be, are you...

Financial Stress Tips

3 June 2020

Let's start with a reminder. This is a judgment-free zone. Taking advantage of the financial options available to you does not make you a failure or a cheat. It makes you a person with resources. Financial stress can take a...

Payments

21 April 2020

I like to think of myself as an expert, I've put in my 10,000 hours, I know mortgages, as I like to say, "I'm a one-trick pony." I only know how to do mortgages. I'm in big trouble if something...

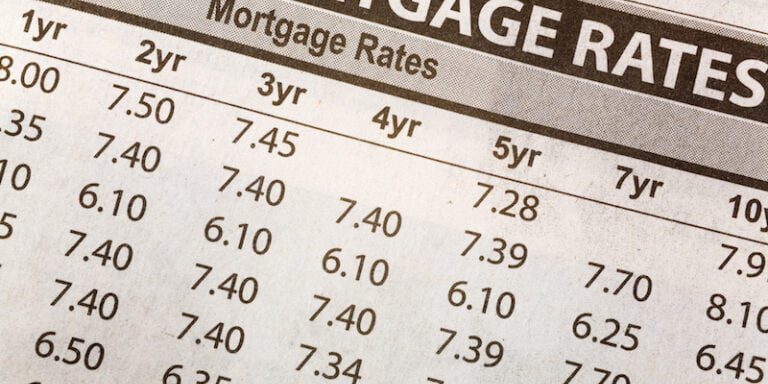

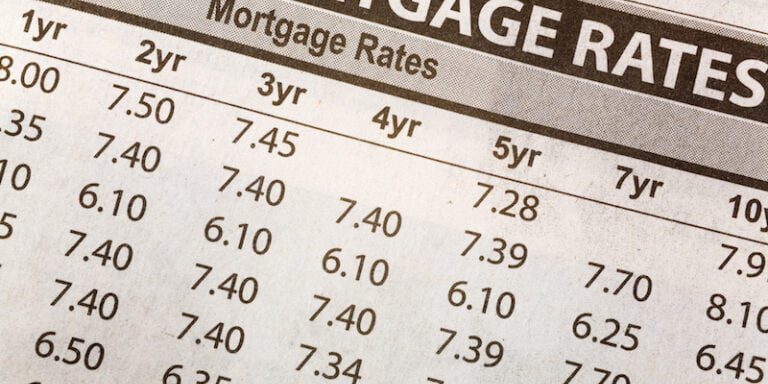

Explanation of fixed and variable

30 March 2020

Let’s talk about rates! Here’s the short story. Yes, the Bank of Canada dropped its interest rate. But it doesn’t affect all mortgages. Specifically, if you have a fixed rate there are no changes for you. Now for the...

Mortgage Repayment(s) – The Perfect Holiday Gift

5 December 2018

Written by DLC agent Ryan Oake Do you know what kind of prepayment privileges you currently have with your mortgage? Does your current lender allow you to make a 10% prepayment or a 20% prepayment on your principle amount? Can...

Why Choose An Accelerated Payment?

21 June 2018

Accelerated payments are payments that increase slightly to allow you to pay down your mortgage faster. There are two common types of accelerated payments: bi-weekly and weekly. Of the two options, bi-weekly accelerated is the most common choice because it...

Frugal Tips

11 January 2018

2018! Do you remember when you were a kid and 2010 was so far away? And now, here we are 2018 with two more years until 2020. Each year I name my year, I give it a title, something to...