May Day! May Day

May Day, May Day! No, not really. But Mother Nature could turn up the heat a little, burrr.

Since the global financial crisis of 2008, we have been enjoying the high life; yes, yes, we have. Money has been so cheap that most of us have been spending like drunken sailors. Well, maybe not that bad. But, cheap money meant we were spending on things we may or may not have needed if we had to pay out of pocket. Many of us, including myself, opted to invest in my TFSA and RSP and keep a higher mortgage balance; why put money on low-interest debt when I can make money for my retirement and save on taxes. This was the right strategy, but now, we might want to start paying attention to paying down the mortgage principal?

Since the global financial crisis of 2008, we have been enjoying the high life; yes, yes, we have. Money has been so cheap that most of us have been spending like drunken sailors. Well, maybe not that bad. But, cheap money meant we were spending on things we may or may not have needed if we had to pay out of pocket. Many of us, including myself, opted to invest in my TFSA and RSP and keep a higher mortgage balance; why put money on low-interest debt when I can make money for my retirement and save on taxes. This was the right strategy, but now, we might want to start paying attention to paying down the mortgage principal?

Heck, I can’t tell you how many times I said to someone purchasing a home, do not take money out of your investments to put on a 2% debt. But, I have also said that anything below 4% is a gift; Canada’s historical interest rate average is 5.5%.

When I bought a property in late 2007 as a rental, my fixed rate (the only time I’ve ever taken a fixed rate because prime was 6ish%, if I recall?) was at 5.89%, yep, 5.89%. I thought it was pretty good. I am a broker, you know. The first time I took a fixed rate, the market crashed six months later, Prime tumbled like a boulder down the mountain, and I was stuck in this mortgage. I digress.

Yes, the news is scary; they have to sell ad time. If you recall, when the Liberal Government took office in 2016, they changed the rules and started to increase Prime in 2017 and would have continued to see an increase except we had a little pandemic -interuptis. Prime at the beginning of 2020 was 3.95%, and the discount – the minus part was not all that great, and the variable rate was and is still the most efficient means to pay off your mortgage. I will repeat – using the variable rate mortgage saves you interest and out-of-pocket dollars (the lower mortgage payment) when you budget for the fixed-rate mortgage payment you would have had to pay. Why pay a lender for a stable rate? There is nothing to be nervous about, yes, your mortgage payment is increasing, but you must remember all the interest you are saving along the way. And the allocation of your payment, you are still paying down the principal more efficiently.

See below for the tale of two amortization schedules

Ideally, everyone listened to me, and they made the mortgage payments the same as the fixed-rate payment would have been, and the difference went to the principal balance. This is likely not the case because life happens, and we forget. Including myself. Sounds preachy, right. Lol.

I will remind you of what I know to be true.

- We have been living in a Pandemic, and we are a little more stressed than we were in 2019.

- A war is happening on the other side of the world, causing financial and human outcome uncertainty.

- Gas and food prices are soaring – causing insecurity

- Inflation is rising – we were spending, and now we need to stop

- The Government will increase Prime by 2.00% – we have seen a 0.75% increase so far (it didn’t hurt too badly, did it), with another 1.25% to go.

- There are not enough houses for the number of people who need and want a home, causing inflated pricing and a scarcity mentality. We are born as Canadians to grow up, get a job, buy a house and take a five-year fixed mortgage. I know; I’ve been trying to convert the masses.

- I believe the next two years will be bumpy as we revert to 2007 interest. Imagine some of the humans in Canada who have never known an interest rate above 3%?

- I also know that this, too, shall pass. We will get used to the new normal.

- I believe rates will return to the Canadian median of mid 4.5% – 5%.

- Our time during the pandemic reminded us of what is important, truly important, and what wasn’t – things. We have enough things.

- Remember to be kind and help others that need it. We are in this together.

- So take a deep breath, and know that right now might not be ideal, but we are strong, and we will get through. We always do.

If you know someone struggling financially, please give them my information, and I will help get them on their path. If I cannot be of assistance, I know people who can. 🙂

The Tale Of Two Amortization Schedules As A Guideline; see the links.

The Two Amortization Schedules Are Based On A Mortgage Of $750,000.00 – 25 Year Amortization

- Remember, when looking at the amortization schedule, you can create your payment as long as it’s above the minimum required.

- Look at the total interest paid over the five-year term. – Yes, the variable rate amortization will change, but look at what is saved in the meantime.

- Many mortgages, especially first-time homebuyers, terminate their mortgages in the first 40 months. You pay the majority of interest in the first two years with a fixed rate. So, if you are one of the ones that terminate your mortgage early, you’ve made the bank very happy.

- Look at the remaining balance of the mortgage.

Let’s get geeky and take a closer look at the math. Saving money is fun.

Insured Mortgage Amount of $750,000.00 at today’s rates

- 5yr Fixed Rate of 4.09% = a monthly payment of $3981.83 – straightforward

- 5- year Variable Rate at 2.25% = Prime minus 0.95% = a monthly payment of $3,267.09 – complicated math – but worth the time.

- A monthly savings of $714.74 – I know I can do a LOT with $714.74 a month or $8,576.88 a year.

- But what if you applied $8,576.88 a year to your principal balance? Or better yet, change your monthly payment to $3,891.83, and the difference goes directly to the principal balance each month. You will be paying off that mortgage in no time.

I am using a monthly payment for ease of writing, but a bi-weekly accelerated payment would have a more significant impact.

We all understand that Prime is increasing. So let’s take a closer look at that monthly payment with a few increases to Prime.

Remember the discount remains at -0.95%

Prime @ 3.20% = $3,267.09 – monthly savings = $714.74

Prime @ 3.45% = $3,359.75 – monthly savings = $622.08

Prime @ 3.70% = $3,453.84 – monthly savings = $527.99

Prime @ 3.95% = $3,549.34 – monthly savings = $432.49

Prime @ 4.20% = $3,646.24 – monthly savings = $335.59

Prime @ 4.45% = $3,744.53 – monthly savings = $237.30

Prime @ 4.70% = $3,844.17 – monthly savings = $137.66

Prime @ 4.95% = $3,945.15 – monthly savings = $36.68

Even with a 2% increase to Prime, you are still saving $36.68 per month – now apply what you save each month to your principal, and you are cleaning up. When we understand the savings, you take away the fear. I am here to support you.

Download 5 year Prime example

Download 5 year insurable fixed rate example

Walter Update

My boy is now 14months old; I’m told these are the teenage years, but that does not make sense to me? If a dog’s age is seven years to our one, doesn’t that mean Walter is eight years old?

After the hiccups of the neutering Walter is doing well and has maintained his puppiness. Which I love.

He is 95 lbs and starts etraining next week. He is getting better at listening and following directions. He loves to go to work with me, you will find him popping up in my Zoom meetings.

He still has not grown into his ears or feet. Lol

This is Walter – Rough Life.

Bank of Canada Prepared to Raise Interest Rates “Forcefully”

Targeting high inflation is the Bank of Canada’s top priority, and it’s prepared to raise interest rates “forcefully” if that’s what’s needed.

Bank of Canada Governor Tiff Macklem made the comment in a speech before the Senate Committee on Banking, Trade and Commerce on Wednesday.

“The economy needs higher rates and can handle them. With demand starting to run ahead of the economy’s capacity, we need higher rates to bring the economy into balance and cool domestic inflation,” he said.

Macklem noted that inflation is now at a three-decade high of 6.7%, and is expected to remain above the Bank’s target range of 1% to 3% for the remainder of the year.

“We are committed to using our policy interest rate to return inflation to target and will do so forcefully if needed,” he added. “How high rates go will depend on how the economy responds and how the outlook for inflation evolves.”

What is certain, Macklem noted, is that Canadians should “expect interest rates to continue to rise toward more normal settings.”

Bank Considering A 50-bps Rate Hike In June: Macklem

Macklem’s comments before the Senate committee come just days after he told a parliamentary hearing that the Bank of Canada will consider a half-point rate hike at its next rate meeting.

“We’ve signalled very clearly Canadians should expect further increases,” he told lawmakers on Monday. “Looking ahead to our next decisions, I expect we will be considering taking another 50-basis-point step.”

While it’s the first time Macklem has hinted specifically at the size of future rate movements, it’s not news to markets, which are already fully priced in for a 50-bps rate hike on June 1.

That would take the overnight target rate to 1.5%. The bond market is pricing in a lower probability of a 75-bps rate hike, though it is possible.

Scotiabank economist Derek Holt referenced such a move in a previous research note.

“The fact that inflation is running amok should drive a minimum 50-bps hike that we forecast at the next meeting in June,” he wrote. “There is even a solid case for the BoC to hike by 75–100bps in one shot.”

These forecasts are in stark contrast to market guidance the BoC delivered in late 2020 when it assured borrowers rates would remain low until economic slack was absorbed, which it said wasn’t likely to happen until “into 2023.”

While the odds of a 75-bps rate hike in June have since diminished since March inflation data was released, it remains at about a 30% chance, according to markets.

“I’m not going to rule out other options, but anything bigger than 50 basis points would be very unusual,” Macklem said.

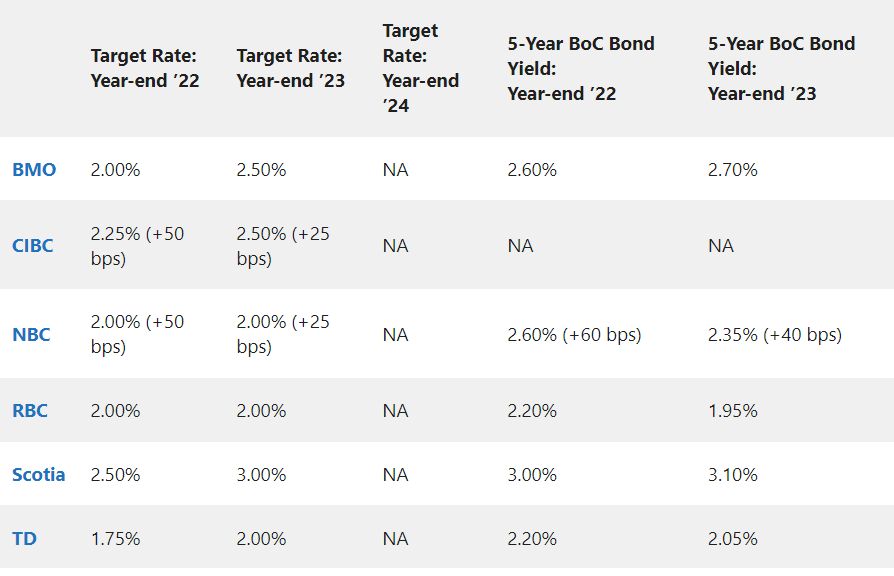

Latest Rate Forecasts

The following are the latest interest rate and bond yield forecasts from the Big 6 banks, with any changes from their previous forecasts in parenthesis.

Budget 2022

On April 7, 2022, the Deputy Prime Minister and Finance Minister, the Honourable Chrystia Freeland, presented Budget 2022: A Plan to Grow Our Economy and Make Life More Affordable,

to the House of Commons.

No changes were made to personal or corporate tax rates, nor to the inclusion rate on taxable capital gains.

Local Market Real Estate Stats

I recently attended a seminar from Sagen. it is always interesting to see the stats to our local market place. The attached is from Sagen and is quite interesting statistics based on the different Ottawa neibhourhoods.

The below PDF is courtesy of McIntyre & Associates Professional Corporation.

Rates

Hold on to your seats:

Prime: 3.20%

Next Bank of Canada Meeting will be June 1/2022 where there is an expected increase to prime of 0.50%

High Ratio Mortgages – default insured

3 year: 3.89%

5 year: 4.09%

10 year: 4.29%

Prime 3.20% – 0.95% = 2.25%

Conventional Mortgages – 20% down or greater

3 year: 4.24%

5 year: 5.29%

10 year: 4.49%

Prime 3.20% – 0.60% = 2.60%

Refinance

5 year: 4.29%

Prime 3.20% – 0.50% = 2.70%

Rates are subject to change at any time, these rates should be considered a guideline.

Local Market Real Estate Stats

I recently attended a seminar from Sagen. it is always interesting to see the stats to our local market place. The attached is from Sagen and is quite interesting statistics based on the different Ottawa neibhourhoods.

The below PDF is courtesy of McIntyre & Associates Professional Corporation.

The Tax-Free First Home Savings Account (“FHSA”) Explained

If you or someone you know is saving for a downpayment on their first home, the Federal government announced a new program aimed at firsttime buyers in their recent budget. The First Home Savings Account combines the features of an RRSP and a TFSA to give prospective homeowners some tax relief and a boost toward their homeownership goals.