Understand Your Credit Score And How Credit Works For You

It’s important to understand your credit score and how credit works for you.

Here’s my coles notes version of how to use and keep a fantastic credit score. Below you find the technical reasons.

What every Canadian needs:

- Two high-quality credit cards from different lenders. Think Big Banks, AMEX and the like. NOT department store.

- One Line of Credit.

- Keep high limits with low balances; this speaks to ratios of use, if you only use 50% or less of you limit your score will be stronger. When you start going above 50% of your limit your score can start to slip.

- Pay your bills on time, every time. If you can only pay the minimum great. Just make sure you make the payment.

- That is it! Follow these few simple tips and you will have fantastic credit always. If you’d like to discuss, the why and how’s call me. I love credit, talking about credit and educating people about how to use credit.

Understanding your credit score 101:

Driven by the financial industries desire for an equitable method of comparing the credit worthiness of borrowers, Fair Isaac & Co developed a credit measurement tool in the 1950’s called the FICO score, in Canada it’s called a Beacon score.

Now considered to be the industry standard.

BEACON score:

The most recognized credit reporting agencies are Equifax and TransUnion, with Equifax being the most recognized agency in Canada.

How is a BEACON score determined?

In general terms*, the BEACON score evaluates five main categories of information:

Payment history (35% of the overall score)

- Account payment information on specific types of accounts (credit cards, retail accounts, installment loans, finance company accounts, mortgage, etc.).

- Presence of adverse public records (bankruptcy, judgments, suits, liens, wage attachments, etc.), collection items, and/or delinquency (past due items).

- Severity of delinquency (how long past due).

- Amount past due on delinquent accounts or collection items.

- Time since (recently of) past due items (delinquency), adverse public records (if any), or collection items (if any).

- Number of past due items on file.

- Number of accounts paid as agreed.

Amounts owed ( 30% of the overall score)

- Amount owing on accounts.

- Amount owing on specific types of accounts.

- Lack of a specific type of balance, in some cases.

- Number of accounts with balances.

- Proportion of credit lines used (proportion of balances to total credit limits on certain types of revolving accounts).

- Proportion of installment loan amounts still owing (proportion of balance to original loan amount on certain types of installment loans).

Length of credit history ( 15% of the overall score)

- Time since accounts opened.

- Time since accounts opened, by specific type of account.

- Time since account activity.

New credit ( 10% of the overall score)

- Number of recently opened accounts, and proportion of accounts that are recently opened, by type of account.

- Number of recent credit inquiries.

- Time since recent account opening(s), by type of account.

- Time since credit inquiry(s).

- Re-establishment of positive credit history following past payment problems.

Type of credit used ( 10% of the overall score)

- Number of (presence, prevalence, and recent information on) various types of accounts (credit cards, retail accounts, installment loans, mortgage, consumer finance accounts, etc.)

Add it up and you get…?

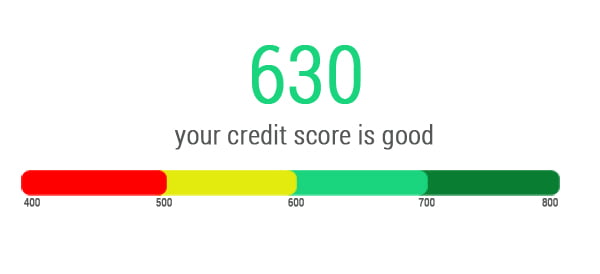

- Each of the above noted factors, along with others, are assigned a value and a weight. The results of these factors are then added up and combined into a single number. BEACON scores can range from 300 to 900. The higher the number the better.

- In general terms, borrowers with reasonable credit typical have BEACON scores, which range between 600 and 900. The average Canadian score is 760.

Comments:

A score takes into consideration all these categories of information, not just one or two.

No one piece of information or factor alone will determine your score. The importance of any factor depends on the overall information in your credit report.

For some people, a given factor may be more important than for someone else with a different credit history. In addition, as the information in your credit report changes, so does the importance of any factor in determining your score. Thus, it’s impossible to say exactly how important any single factor is in determining your score – even the levels of importance shown here are for the general population, and will be different for different credit profiles. What’s important is the mix of information, which varies from person to person, and for any one person over time.

Your Beacon score only looks at information in your credit report.

However, lenders look at many things when making a credit decision including your income, how long you have worked at your present job and the kind of credit you are requesting. How often you move, this determines your stability.

Your score considers both positive and negative information in your credit report.

Late payments will lower your score, but establishing or re-establishing a good track record of making payments on time will raise your score.

The way the lender sees you:

- Capacity – your ability to pay – Can you afford the home

- Credit – how do you handle your obligations – do you pay your bills

- Capital – down payment – how much – where is it coming from

- Collateral – Is the property of good value – is it marketable

- Character -This is Your Reputation. Are you reliable? What’s your employment history? Are stable or do you move around a lot?

You thought mortgages were about rates! Should you have any questions or are considering getting or refinancing a mortgage please call or email me for a personal appointment.